How Do I Complete A Banks Kyc Anti Money Laundering Requirements

KYC (Know Your Customer) is today a pregnant element in the fight against financial law-breaking and money laundering, and customer identification is the virtually critical aspect as it is the offset pace to amend perform in the other stages of the process.

The global anti-money laundering (AML) and countering the financing of terrorism (CFT) landscape raise tremendous stakes for financial institutions.

International regulations influenced by standards like The Financial Activeness Task Forcefulness (FATF) are at present implemented in national laws encompassing potent directives similar AML 4 and 5 and preventive measures like "KYC" for client identification.

Let'south kickoff with a definition of KYC and eKYC and detect how advanced ID verification systems tin better support KYC processes.

Ready?

What is KYC?

KYC means Know Your Client and sometimes Know Your Client.

KYC or KYC check is the mandatory procedure of identifying and verifying the client's identity when opening an account and periodically over fourth dimension.

In other words, banks must make sure that their clients are genuinely who they claim to exist.

Banks may refuse to open an business relationship or halt a business relationship if the customer fails to meet minimum KYC requirements.

Why is the KYC process important?

KYC procedures defined by banks involve all the necessary deportment to ensure their customers are real, assess, and monitor risks.

These client-onboarding processes help foreclose and identify money laundering, terrorism financing, and other illegal corruption schemes.

KYC process includes ID card verification, face verification, certificate verification such as utility bills equally proof of address, and biometric verification.

Banks must comply with KYC regulations and anti-money laundering regulations to limit fraud.KYC compliance responsibleness rests with the banks.

In case of failure to comply, heavy penalties can be applied.

In the U.S., Europe, the Middle East, and the Asia Pacific, a cumulated USD26 billion in fines have been levied for non-compliance with AML, KYC, and sanctions-fines the past ten years (2008-2018) - let alone the reputational impairment done and not measured.

Co-ordinate to the United Nations, criminals are laundering betwixt $1.half-dozen to $4 trillion (between 2 to 5% of global GDP) annually. Stricter KYC/CDD processes are helping to stop that.

KYC documents

KYC checks are done through an independent and reliable source of documents, data, or data. Each client is required to provide credentials to testify identity and address.

In May 2018, the U.S. Financial Crimes Enforcement Network (FinCEN) - added a new requirement for banks to verify the identity of natural persons of legal entity customers who own, control and profit from companies when those organizations open up accounts.

Bottom line: when a corporate company opens a new account, it will take to provide Social Security numbers and copies of a photo ID and passports for its employees, lath members, and shareholders.

What is eKYC?

- In India, Electronic Know Your Customer or Electronic Know your Client or eKYC is a process wherein the customer's identity and address are verified electronically through Aadhaar authentication. Aadhaar is India'due south national biometric eID scheme.

Why is eKYC and so popular in India?

It's because 99% of the adult population has a digital identity in the country. In January 2022, ane,3 billion residents got their Aadhaar number.

- eKYC besides refers to capturing information from IDs (OCR way), the extraction of digital information from government-issued smart IDs (with a scrap) with a concrete presence, or the use of certified digital identities and facial recognition for online identity verification.

Customer onboarding tin can then be washed via mobile.

eKYC (aka online KYC) is considered more than and more feasible equally its accuracy is improving by utilizing Artificial Intelligence (AI).

eKYC, facial recognition, and digital business relationship opening

Banking is undoubtedly the area where facial recognition was to the lowest degree expected.

And yet, information technology promises a lot.

KYC onboarding with facial recognition online is a hot topic in 2021.

Why?

Covid-19 pushed customers and banks to rely more heavily on digital channels and apps.

64% of primary checking account openings were done online in Q2 2020 ( and 36% in branch) in the United States alone.

And this is non going to change.

A recent written report from Visa and BAI showed that the trend would continue afterwards the pandemic.

Across that, increased mobile usage urges businesses to have a mobile-first focus and develop fully mobile user-friendly onboarding experiences.

During the identification process (a selfie), the software usually provides a liveness detection feature to avert spoofing attacks using a static image. Liveness detection proves that the selfie taken comes from a live person.

This type of KYC cheque is also used for cryptocurrency trading apps.

The result?

Financial institutions tin invest in digital onboarding, including video KYC (video identification), and leverage biometrics through online and mobile channels to arrange to current customer preferences.

Anti-Money Laundering Directive

In Europe, the quaternary Anti-Money Laundering (AMLD4) directive entered into strength in June 2017, with a new set of rules to help financial entities protect against the risks of coin laundering and financing of terrorism.

The enhanced version of the fifth AML directive (AMLD5), effective as of ten January 2020, brought new challenges for financial institutions:

- Improve understanding of customers, benign owners of legal entities, and their financial dealings to minimize risk

- Stricter Client Due Diligence (CDD)

- Command customer identity and share information with key assistants

- European union member states must implement the directive within 2 years.

KYC process catamenia

KYC and Customer Due Diligence measures

The KYC policy is a mandatory framework for banks and financial institutions used for the customer identification procedure. Its origin stems from the 2001 Title Iii of the Patriot Act to provide various tools to prevent terrorist activities.

To comply with international regulations against money laundering and terrorist financing, reinforced Know Your Customer procedures demand to be implemented in the outset stage of whatever business relationship when enrolling a new customer.

Banks usually frame their KYC policies incorporating the following four fundamental elements:

- Client Policy

- Client Identification Procedures (data collection, identification, verification, politically exposed person/sanctions lists cheque) aka Customer Identification Plan (CIP)

- Risk assessment and direction (due diligence, part of the KYC process)

- Ongoing monitoring and tape-keeping

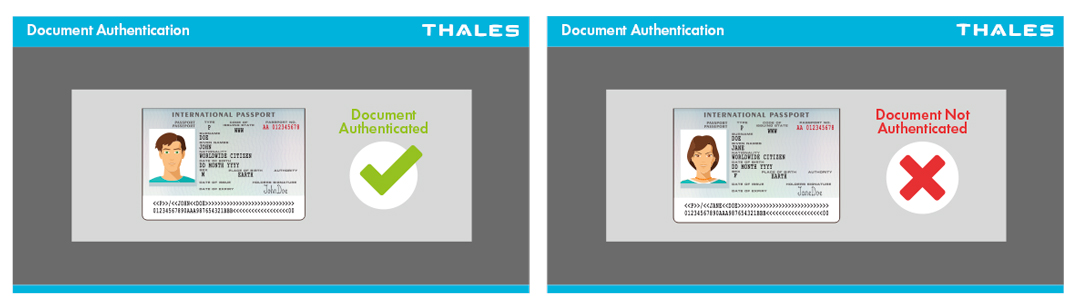

This involves verifying a customer's identity through documents, including a national ID Document with a document reader and avant-garde certificate verification software.

From visual ID check to digital verification

For some, this is still primarily a paper-based check with KYC forms to fill up. Run into examples here.

For others, information technology's a digital process that involves verifying that an identity certificate is genuine or fifty-fifty going farther to cosign the document holder through additional biometric checks such as facial or fingerprint checks.

A digital ID verification process enables a bank to automatically capture client demographic data, which can be integrated into enterprise systems like CRM to:

- streamline the customer onboarding process,

- deport further due diligence and gamble assessment,

- review for PEPs (Politically Exposed Persons).

Financial institutions must also maintain records on transactions and Data obtained through the Client Due Diligence measures.

These requirements should apply to all new customers and existing customers based on materiality and take a chance.

Enhanced Due Diligence (aka EDD) is a KYC procedure that implements a more profound analysis to provide college identity balls.

KYC verification: Innovative approaches welcome

In November 2018, United states of america agencies, including the Federal Reserve, issued a joint declaration that encourages some banks to get increasingly sophisticated in their approaches to identifying suspicious activeness and experimenting with artificial intelligence and digital identity technologies.

The European Supervisory Regime promoted new solutions to address specific compliance challenges earlier in the year. They suggest retaining a common approach for consistent standards across the EU.

They anticipate several types of control, such as «a built-in computer application that automatically identifies and verifies a person from a digital paradigm or a video source (facial biometrics)" or "a built-in security feature that tin detect images that are or have been tampered with (e.chiliad., facial morphing) whereby such images announced pixelated or blurred."

The use of biometrics tin exist challenged by local or regional regulations (GDPR in the Eu, CCPA in California, to proper noun a few).

Read our web dossier on biometric data and data protection regulations on this topic.

How can we assist?

With strong expertise in ID verification for governments, Gemalto supports individual customers past providing a solution that helps them comply with the new rules, particularly those regarding CDD (Customer Due Diligence) and KYC obligations.

ID Verification helps banks provide a polish customer onboarding feel that complies with KYC regulations and minimizes fraud chance.

Our solution automatically provides, in a matter of seconds:

- digital capture of customer information for instant auto-fill up in enterprise data systems

- multichannel identity document verification, with adaptable security levels

- the option of customer authentication using biometric technologies

- the option of customer risk assessment through the review of PEPs, sanction or sentry lists

Our system is using the A.I. approach, where the organisation is capable of learning from data.

Information technology's a primal component of the latest-generation algorithms developed by Thales in its ID Verification systems.

In short, you volition apace increment youronboarding rate equally the system learns and gets improve all the time.

More than resource on AML/KYC

- FATF recommendations 2012

- The Anti-Money Laundering Act of 2020 (FinCEN June 2021)

- Sanctions and Anti-Money Laundering Human action 2018 (Uk)

- KYC and eKYC in Bharat: What is KYC equally per RBI?

- RBI Allows Video-based KYC withal (Coin life India Jan 2021)

- Video KYC for digital bank opening is growing in India (02 March 2021 - The Hindu)

- Indian telcos need Aadhaar-based e-KYC for verification charges to be reduced (Financialexpress.com, 8 Oct 2020)

- Bank KYC updating: No Penalty on Indian Banks (Moneylife, March 2021)

-

PPP, SMBs and the challenges of KYC (pyments.com,16 October 2020)

-

KYC compliance tin can exist a competitive reward (cointelegraph.com, 6 October 2020)

-

KYC and digital-kickoff in cyberbanking (x December 2021)

-

More than on biometrics and its contribution to identification and verification

- Facial recognition in 2021: 7 trends to lookout man

- Discover IdCloud KYC, Gemalto Advanced ID verification solution

Source: https://www.thalesgroup.com/en/markets/digital-identity-and-security/banking-payment/issuance/id-verification/know-your-customer

Posted by: hancockdranch.blogspot.com

0 Response to "How Do I Complete A Banks Kyc Anti Money Laundering Requirements"

Post a Comment